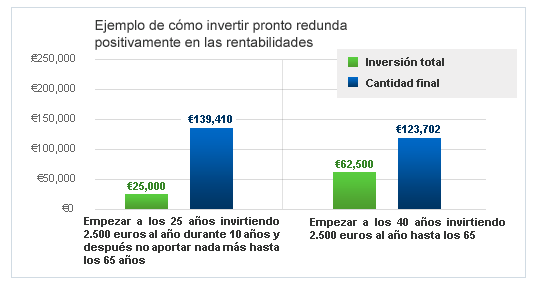

It doesn’t matter how small an investment is. Saving periodically in the long run can result in a considerable sum. The key to success lies in giving your investment the time it needs to grow.

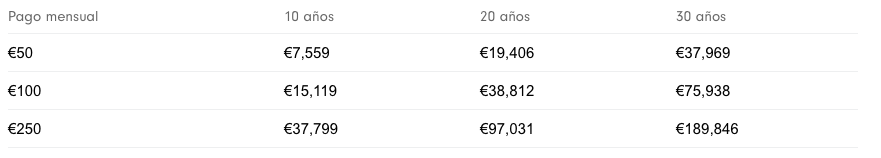

Choose the amount you want to invest and order automatic transfers. Once you start, you will probably not even notice that this amount comes out of your monthly budget, it will be like another periodic expense.

You’ll be surprised at how much small amounts can grow over several years.

The table shows how much your investment could be worth if you had invested in a fund that had appreciated by 6% and had an annual management fee of 1.5%.

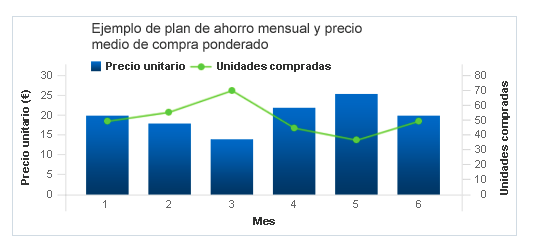

Periodic reversals can smooth out the ups and downs over time. If the market fluctuates, with the strategy known as average purchase price

When the market falls, you can buy more shares with your regular payments. Obviously, when the market rises, you will buy fewer shares, but the ones you bought during the previous months will be worth more.

Don’t forget to increase your investment over time as the years go by, you will probably be able to increase the amount you invest each month. This will give your investment a valuable boost.

Each market behaves differently at any given time, so the most effective way to achieve constant returns is to distribute your capital among different types of assets and/or markets. This practice is known as diversification.

Diversification provides greater growth potential, as your portfolio does not depend on any one company, fund or sector doing well. Therefore, if one of your investments doesn’t do as well, others might behave better and compensate. In this way, you reduce your potential risk.

Diversification can be achieved in different ways:

– By asset class: the simplest form of diversification is to spread the capital across stocks, bonds, cash and property.

– By country: if you invest not only in one country but internationally, you avoid linking your investment to the fate of a single market, in this case that country.

– By economic sectors: invest in a variety of sectors, such as energy, financial services, industry, health.

– By investment styles: it creates a balance between funds that concentrate on growth-style stocks – offered by expanding companies – and those that invest in value-style stocks – those whose potential has not yet been recognised by the market and are therefore underpriced.

It is important to take a long-term perspective (usually 10 years or more) and remember what your reasons are for investing. Be prepared to deal with different personal circumstances through your bank account.

Normally we should have 3 monthly payments in it. This way, you avoid having to undo the savings you’ve been planning for so long.

These occasional circumstances are an element of your long-term savings strategy, so you should not deviate from your objective.

Studies show that historically, the longer you keep your investment, the less likely you are to lose money and the more likely you are to earn it.

Obviously, it is important to remember that past performance does not promise or guarantee future performance and the value of your investments may go up or down.

Time to grow: give your money as much time as possible to grow. The best is at least 10 years, with attractive returns. Take a good look at which savings vehicle you take, because not all long-term savings vehicles offer the same. In the medium term, at least 5 years, we also find an attractive return.

Remember that financial mathematics plays an important role and you will benefit from the effect of compound capitalization, which is when the interest or income from your initial capital begins to earn and grow as well.

Keep the investment: Keep the savings no matter what happens. That is why your advisor will probably have recommended that you use a short-term savings account with little or no return, which is the well-known bank account. During these moments, emotions may outweigh decisions to undo the savings, hence the importance of not deviating from your long-term investment objectives and being able to deal with personal financial circumstances through the bank account.